New year, new financial goals

Now that we’re in a new year, it’s time to start thinking about how we can improve for the future and do things differently. One of the best ways to prepare for success in 2022 (and beyond) is to explore ways to put your finances in the best possible shape. In one new study On adult spending habits in PA, NJ, DE and MD, residents are looking for a financial reset. Of those polled, 56% say they are likely or extremely likely to make financial resolutions in 2022.

Budgeting is the number one financial resolution in 2022

As goals and resolutions come and go, a New Year means a new opportunity to take control of your finances by taking action.

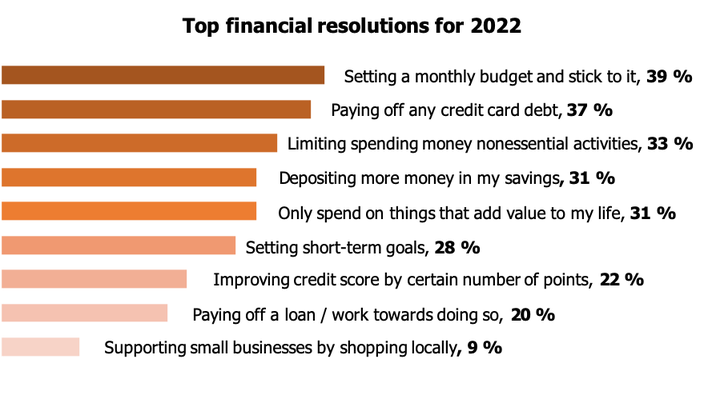

In the recent study, residents were asked to choose their top 3 financial resolutions as the New Year approaches. Setting and sticking to a monthly budget was the most popular response among residents, selected by 39%, followed by paying off 37% credit card debt and limiting spending on non-essential activities, like eating. in the restaurant, which was a priority for 33%.

Budgeting was a higher priority for women in the region than for men, with 44% of women choosing it among their top 3 resolutions, compared to 32% of men. Meanwhile, paying off credit card debt and limiting non-essential spending were higher priorities for men than women (40% vs. 35% and 36% vs. 30%, respectively).

![Limited - PFCU - New Years Chart]()

Philadelphia Federal Credit Union:

Vacation Spending and Saving Habits Among Metro Philadelphia

Residents, November 2021

Philadelphia Federal Credit Union: Vacation Spending and Saving Habits Among Metro Philadelphia Residents, November 2021

3 tips to put your finances on the path to success in 2022

If you’re starting the New Year with a list of resolutions, consider adding these financial tasks:

1. Review and update your annual

budget

New year, new

budget. By performing an annual

review, you can create and / or reassess your overall financial

goals. This annual review is different from your more frequent

weekly financial checks because you are able to set long-term goals

for the next 12 months. If you’ve never set financial goals, just

think of them as what you hope to get out of your money each year.

These goals can be as simple as paying your bills on time each

month, or as complex as creating a savings plan to help you buy your

dream home. Your annual budget review should also compare what you

hoped to spend, how much you actually spent, and / or if there are

any areas of your budget that you can reduce.

You should also use your annual budget audit as an opportunity to assess and allocate your finances for future big events, such as a wedding, home renovations, or if you are planning on expanding your family. January is also the time when many companies begin open registrations for health and dental / optical, 401K, and retirement benefits, which you can choose to participate in.

While financial goals can be different from person to person, no matter what they are, they will hopefully end up with the same result: helping you understand why you are spending your money a certain way.

2. Start the year off right with savings

Now that

you’ve reviewed your budget, looked for ways to cut out the things you

don’t need, and have a better understanding of your new financial

priorities, you can start thinking about a savings plan. By saving early

in the year, you are creating a positive habit. Once you start putting

money aside, you won’t stop. Here are some helpful tips for starting a

savings account / emergency fund:

-

Calculate a dollar amount or percentage of your income each month that you can afford to put into savings.

-

Take that amount from your paycheck each month and deposit it straight into your savings account, or put it out of sight but somewhere you’ll remember its location.

-

Don’t think of these funds as extra money lying around that can be used for anything.

-

Do not use your savings fund unless it is a real emergency, or for the reason you opened the savings account in the first place.

Starting the year saving will hopefully put you on the right track to securing your finances in 2022.

3. Create a suite of personal finance resources to reference in the

blink of an eye

Make sure you have easy

access to the financial information that will come in handy when you

need it most. You need to have a set of resources that will help you

answer all of your personal finance questions quickly and easily. In

the Education section From

the PFCU website, you can find a wealth of resources to help answer

many of your most pressing financial questions, including:

-

Credit reports

and advice to make sure your credit is in the right place and / or how to get there. - The

Clarifi information library

can help you on the path to creating a healthy financial life. - Calculators

to accurately calculate your taxes, mortgages and real estate, investment and retirement, etc. -

Webinars, you can either attend or watch a

registration

de, which offer detailed information on various financial topics, such as: saving and planning for your children, money management and school fees. - Moneyline Blog, which has articles that can give you advice on a number of topics including: budgeting for a wedding, paying for college, how not to break the bank on vacation meals and shopping, and more.

These resources can also be physical files that you have printed and stored somewhere to be removed when you need them. It’s a good idea to have them on hand so you can have peace of mind knowing that if a complicated financial question were to arise, you would be able to easily find the answer. PFCU also offers additional resources and information to its members, and will work with them to achieve their financial goals. For more information visit pfcu.com.

By using these tips, we hope that you will establish and maintain good financial habits that will accompany you in all aspects of your life.

To see the full research report, visit the PFCU website.

Comments are closed.